Revenue from Cloud contributes to 36% of total revenue.

Mary ly splunk revenue software#

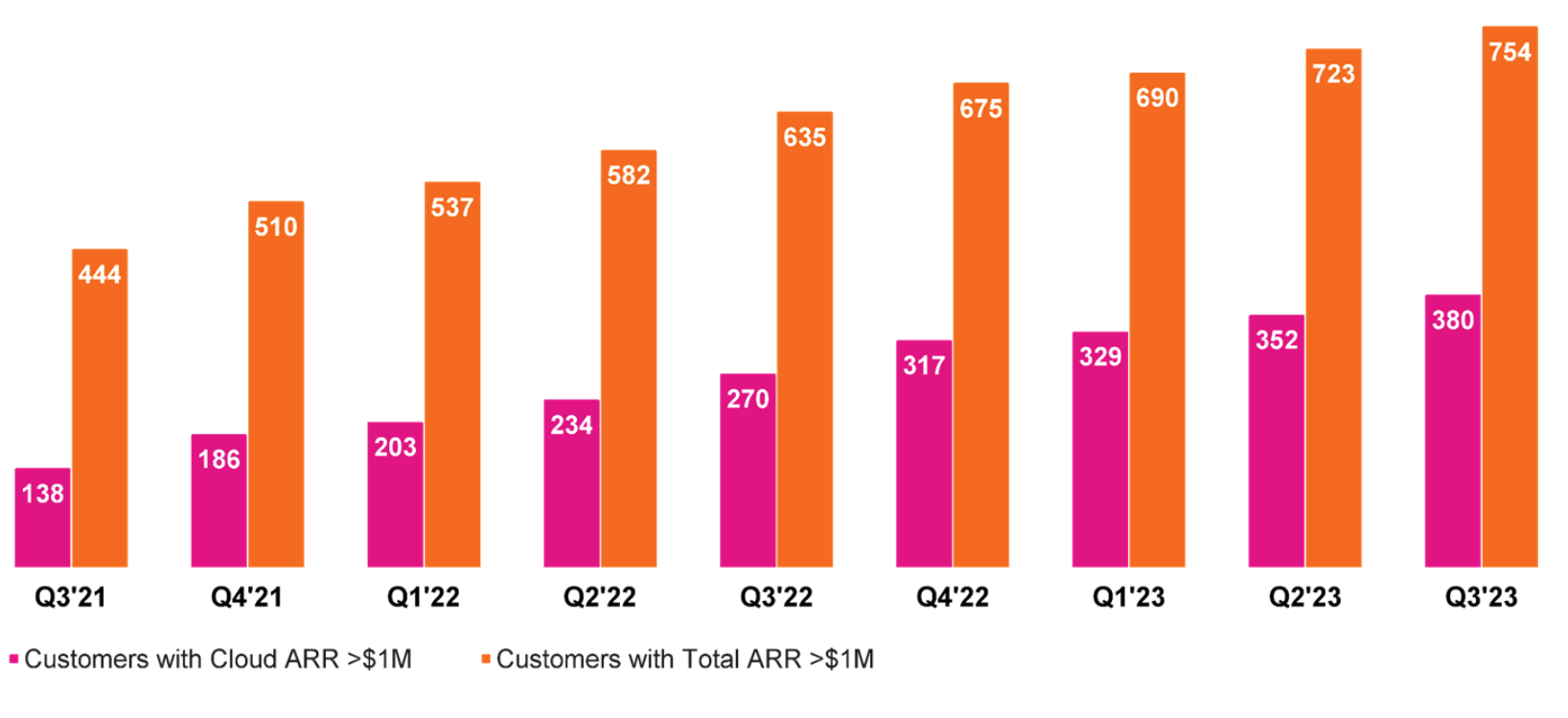

Cloud contributed to 54% of total software bookings. Cloud ARR again grew north of 70%+ for the tenth consecutive quarter and was up 72% Y/Y.

The company continues to report consistently high renewal and expansion with its cloud customers. Cloud revenue was $217 million and was up 73% Y/Y as customers began adopting its use in increasing numbers. Splunk continues to lean into its Cloud offerings, and it is paying off. The following chart illustrates Splunk's reported results versus consensus estimates. CEO Doug Merritt noted that Splunk remains a strategic software for many of the world's largest organizations. Splunk's performance was broad-based, with all major geographies exceeding the revenue plan. During Q2, Splunk replaced a significant competitor at a major North American financial services firm. CEO Doug Merritt noted on the call that Workload pricing is lowering the barriers for Splunk to displace competitors. More importantly, 25% of the total Cloud ARR is also based on workload-based pricing. The company also noted that its move to Workload-based pricing away from ingestion-based pricing is being received well.ĭuring Q2, more than 80% of net new Cloud ARR was from workload-based pricing. Investors may remember that enterprises were writing shorter duration contracts over the last 12 months to conserve cash. Revenue was up 23% Y/Y and benefited from normalized contract duration, which was problematic in the prior quarters. Splunk reported a solid quarter with revenue coming in at $606 million versus the consensus estimate of $563 million. The stock is cheap compared to its peer group, which is trading at 15.4x and is only growing at 22%, while Splunk revenue is growing at 21%. Splunk is currently trading at 7.6x EV/C2022 sales. Splunk is a reasonably valued growing software company that will likely put up impressive revenue growth numbers at scale, with a solid and expanding customer base and an industry-leading position. The company acquired cutting-edge assets in each of these areas and integrating them into its platform. Splunk remains the leader in log management, and it has expanded this leadership into adjacent areas such as observability, data fabric search, and stream processing. Splunk is a leader in multiple segments of its business – IT Operations Management, Security Operation, SIEM, etc. More importantly, the company provided commentary that can be summed up as bullish. Splunk reported an exceptional quarter by beating estimates handily and provided guidance that met estimates for the third consecutive quarter. In a press release announcing the acquisition, Splunk said the buy would “help customers deliver cost savings, increased revenue and an improved customer experience.Sundry Photography/iStock Editorial via Getty Imagesįollowing Splunk's ( NASDAQ: SPLK) upbeat F2Q22 results, we are buyers of shares.

The company bought Phantom for $350 million in February 2018, VictorOps for $120 million in June 2018, and KryptonCloud for an undisclosed amount in 2018. The buy marks Splunk’s fourth venture-backed startup acquisition in the last two years, according to Crunchbase data.

Mary ly splunk revenue series#

Andreessen Horowitz stands to gain the most from an acquisition considering the firm backed SignalFx’s $8.5 million Series A in March 2013 and put money in each subsequent funding round.Ĭustomers span a variety of industries including ecommerce, retail, transportation, and health care, and include Yelp, Kayak, Shutterfly and Square, among others. Over the course of its six-year life, SignalFx had raised a total of $178.5 million, mostly from the investors mentioned above. According to the Silicon Valley Business Journal, the acquisition price is “double what the startup was valued at by private investors when it raised funds in June.” At the time of its last raise, SignalFX said in a release its annual revenues had “increased by a compound annual growth rate of 170 percent since sales began in 2015.” It also noted that its headcount was “270 and growing.” The deal comes just two months after SignalFx raised a $75 million Series E that was led by Tiger Global Management and included participation from General Catalyst, CRV and Andreessen Horowitz. Publicly traded operational intelligence software company Splunk announced yesterday it has agreed to acquire SignalFx, a San Mateo-based SaaS cloud monitoring startup, for $1.05 billion.

0 kommentar(er)

0 kommentar(er)